What about holding costs?�

Remember there is a time limit to clear units before penalties kick in (which are 8% / 16% / 24% )�

Interest is also a cost

There is also cash flow to consider

And in a falling market....�

�

�

i agree with you. Whether or not developer can continue to hold will depend on the bigger pic. Their funds are not locked up in sg alone.

�

wife's good friend..�

�

bought HDB at 300K. Sold at 500K

�

upgrade to condo at 1.1m. Sold at 1.6m

�

upgrade to good district condo at 2.5m... sold at ??? (in future)

�

of course, all these happened during the 2004 to 2013 period.

�

According to my mother in law and my wife, they are very clever. Even though debts went up from 100K to now 1m (or more?), they have "made it" in life.. no matter how the mkt crash, they will still be in the money. both couple working, raking in nearly 20K a month (main income earner in high risk industry aka financial services)

�

too difficult to explain to them, so i just go along and agree�

�

better to get something they can understand like residential, since 90% of people out there are experts with a view

�

Increase rate goes up then booooooooommmmmmzzzz

�

Over leveraged people will cry. Poor people like me just watch and pity them.

�

Increase rate goes up then booooooooommmmmmzzzz

�

Over leveraged people will cry. Poor people like me just watch and pity them.

taking high debt.. wah.�but still earning 20k� month. ok lar, if they�still work for�the rest�of the yrs. without income to service loan.. tat's the worst part. i know many ppl taking huge debt n rely on their monthly income to service the loan, is pointless to be able to buy a million condo and�not�being financial freedom.�

taking high debt.. wah.�but still earning 20k� month. ok lar, if they�still work for�the rest�of the yrs. without income to service loan.. tat's the worst part. i know many ppl taking huge debt n rely on their monthly income to service the loan, is pointless to be able to buy a million condo and�not�being financial freedom.�

�

20k for 2 working adults actually not so ok lah. It is quite common. 20k per working adult then still not too bad lah.

�

The bottomline is: properties here are way overpriced

�

need password leh

�

Throttle2's wet dream need password one... yes.....

�

Throttle2's wet dream need password one... yes.....

�

how cum Sabian has the password to Throttle2's wet dream leh

�

20k for 2 working adults actually not so ok lah. It is quite common. 20k per working adult then still not too bad lah.

�

The bottomline is: properties here are way overpriced

�

�

�

�

�

Among resident employed households1, median monthly household income from work2 increased from $7,040 in 2011 to $7,570 in 2012, a 7.5 per cent growth in nominal terms, or 2.7 per cent in real3 terms

�

�

�

ha ha ha .. the crowd in MCF .. damn rich..

Apa ini?http://www.valuebudd...ent.php?aid=647

�

Throttle's wet dream cumming...

I dont care about where the property market goes lah.

With so little money, wont make any difference anyway.

I care more about me and my family's overall standard of living and well being.

I leave the market to kill each other over it.

Edited by Throttle2, 21 January 2014 - 06:27 PM.

Wah lau $20k is very a lot leh, otherwise then people like me who earn on $4.2k better go commit suicide already.... Sob sob....�

20k for 2 working adults actually not so ok lah. It is quite common. 20k per working adult then still not too bad lah.

�

The bottomline is: properties here are way overpriced

The bottomline is properties here are way overpriced.

Edited by Throttle2, 21 January 2014 - 08:06 PM.

Wah lau $20k is very a lot leh, otherwise then people like me who earn on $4.2k better go commit suicide already.... Sob sob....

The bottomline is properties here are way overpriced.

�

Not bad lah D. Your "coolie kang" increased from previous 3.7k to 4.2k. That's a 13.5% increase

�

Not bad lah D. Your "coolie kang" increased from previous 3.7k to 4.2k. That's a 13.5% increase

Brother, i $4.2k very the long already, simi increase?. :(

That thinking is muddle headed.�

Where got "accept" or not accept losses?�

�

If a property is only "worth" $X, then that is its value - whether I want to accept it or not.�

Remember also that there are holding costs, as well as govt penalties for unsold units in a development.�

�

Think this way...

�

Lets say your cost is $1 million

Interest on the loan 2% is $20k per year.�

Got govt penalty of 8% per additional year if unsold. �This works out to $100k -�

Would you sell now for $920k or hold on for a year? �

�

And that's before things like cash flow and a dropping market come in...

�

�

�

Would be interesting to know how many unsold units there are across all the recent releases. �

BTO needs 80% before go ahead right? �That means that potentially there are 20% unsold...

�

That's a lot of units!�

�

Also, once fully build, the area is going to be horribly crowded...I hate to think what TPE is going to be like in 5 years

Thanks for reminding me, I was about to post on the jam... I notice the jam starts when I turn into slip road to the toward sle direction almost on every morning since beginning of the year,... Same timing and routine, around 7:35am.. It was never that bad last year...Slow speed, start stop, all the way until sle.. It's going to be very chialat when most of punggol bto hand over keys.....

Brother, i $42k very the long already, simi increase?. :(

�

u typo, i help you correct

�

�

u typo, i help you correct![[lipsrsealed]](https://lh3.googleusercontent.com/blogger_img_proxy/AEn0k_tH2cbON7tbFDMbcMjT4NFfAr9fBisqj9G0NW3kx4pRoAshfoYLuWNESFGQac5dFaXkIg8dtSymadiXv_QYO77Og_5hp2F7NkJN_n5o-G3ltdZkiSDMqEJPaUeiUB8KknDBc9BUhr5gCwJWJg=s0-d)

�

Hello, dont anyhow correct hor! Wah lau!

Ok I spell out.

Singapore dollars four thousand and two hundred only.

Hello, dont anyhow correct hor! Wah lau!

Ok I spell out.

Singapore dollars fourty thousand and two hundred only.

Help you corrected.... Hehehe..

Help you corrected.... Hehehe..

Your spelling buay pass leh

Your spelling buay pass leh

What to do, boh tuck chek mah...

Knn. Throttle2 math cmi. You England cmi.What to do, boh tuck chek mah...

Which is which?

Wah lau $20k is very a lot leh, otherwise then people like me who earn on $4.2k better go commit suicide already.... Sob sob....

The bottomline is properties here are way overpriced.

4.2k single income can drive porsche and stay landed property

I 1k should be able to drive BMW and stay condo right?

4.2k single income can drive porsche and stay landed property

I 1k should be able to drive BMW and stay condo right?

�

�

he's giving you the figure for this wkly entertainment allowance lah

Cigar allowance niah

let's say for similar size unit ...

buyer A bought $1M+ during launch

buyer B bought $850K-$900k close/after to TOP

can buyer A "sue" developer for undercutting price to clear unsold units? what's the law says?

If buyer B bought $1.1M... can developer ask buyer A to top up $100k?

Edited by Ben5266, 22 January 2014 - 10:35 AM.

Hello, dont anyhow correct hor! Wah lau!

Ok I spell out.

Singapore dollars four million and two cents only.

Wow!

If buyer B bought $1.1M... can developer ask buyer A to top up $100k?

Edited by Wt_know, 22 January 2014 - 10:52 AM.

you got a valid point. i do know that in china, buyers storm into devveloper ofice and demand to cancel their purchase when developer cut price more than 20% to clear unsold units.

�

�

�

But I think in SG, buyers can only LLST...

Edited by Strat, 22 January 2014 - 10:57 AM.

you got a valid point. i do know that in china, buyers storm into devveloper ofice and demand to cancel their purchase when developer cut price more than 20% to clear unsold units.

�

Yeah, in SG, some developers are govt or kawan of govt...

if we storm their office.. they send us to Changi.

�

...but we can sign price protection contract like.. within 2-3 years, if price drop >5%, developer will refund xx%.

Hello, dont anyhow correct hor! Wah lau!

Ok I spell out.

Singapore dollars four thousand and two hundred only.

�

per day

�

�

But I think in SG, buyers can only LLST...

�

as with most things in SG...

just like CM roll out showroom open till midnight and bank can approve loan until 11.59pm ... really bo ko leng

actually my point is ... in the tv programme the "analyst" commented developer will not cut price drastically for existing project aka unsold units ...

those bought already will suffer a great loss if the project value goes down. new project ... may be.

Edited by Wt_know, 22 January 2014 - 03:03 PM.

agents are hungry and the knife is getting blunt on chopping board after a heavy kill since 2010-2013

Edited by Wt_know, 24 January 2014 - 08:17 PM.

Buy-to Lease hotel rooms ... ai mai?

�

http://www.castlewoo...anner/20131118/

�

�

�

Edited by Wt_know, 25 January 2014 - 12:22 AM.

$1mil is not enough to retire in Singapore

No.

$1mil is not enough to retire in Singapore

... last time... six million dollar man.... wow!

�

Bill Gates can hire 100 as his body guard.

No.

$1mil is not enough to retire in Singapore

�

My Ah gong has less than $100k in his bank account and he has happily retired for many years. �

Edited by Albeniz, 25 January 2014 - 08:42 AM.

�

If it sound too good to be true, it's probably is.

�

�

My Ah gong has less than $100k in his bank account and he has happily retired for many years. �

That time can..... Now cannot....

he stil has safety net... family can still support him....

SINGAPORE:�The HDB resale market may have turned the corner, with a more neutral balance between sellers and buyers, but it has not reached its steady state yet.

National Development Minister Khaw Boon Wan made the remark in his blog on Saturday morning.

He was referring to the last quarter's resale data that the Housing and Development Board (HDB) released on Friday.

He noted that over the next three years, 80,000 new HDB flats will be rolled out, and 30,000 of them will be completed in this year alone -- more than doubling last year's figure.

Most buyers of these new flats will be first-timers.

"But some, not a small number, are flat owners who will need to dispose of their existing flats within six months after collecting keys to their new flats," Mr Khaw said.

Of the 18,100 HDB resale transactions, 2,800 units came from households in the process of moving to their new flats.

The authorities expect the number to double to about 6,000 units each year, in the coming three years.

The number does not include those selling their HDB flats to move into newly completed private property.

Mr Khaw said: "This will no doubt have an impact on the resale HDB market, starting from this year. We will be monitoring closely. I am sure flat hunters and sellers will too."

Data released by the HDB on Friday showed that prices of HDB resale flats registered a 0.6 per cent decline last year -- down from the 6.6 per cent price growth seen in 2012 and the double-digit growth in the two years before that.

As for the fourth quarter last year, prices fell 1.5 per cent, marking two consecutive quarters of price declines in 2013.�

- CNA/al

alamak ... does that mean these owners buy BTO on high side and sell existing HDB on low side?

double whammy ? good luck!

�

�

Most buyers of these new flats will be first-timers."But some, not a small number, are flat owners who will need to dispose of their existing flats within six months after collecting keys to their new flats," Mr Khaw said.

Edited by Wt_know, 25 January 2014 - 04:40 PM.

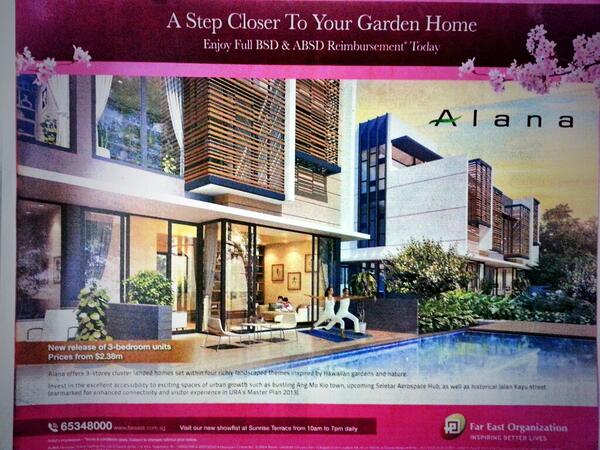

FEO chut pattern liao ... more to come

�

BSD & ABSD reimbursement ... so 1st timer got noting? lol

�

Edited by Wt_know, 26 January 2014 - 11:30 AM.

FEO chut pattern liao ... more to come

�

BSD & ABSD reimbursement ... so 1st timer got noting? lol

�

Equivalent to price drop right?

FEO 2012 champion drop to No.5 in 2013 ... so 2014 must work triple hard

�

Edited by Wt_know, 26 January 2014 - 01:11 PM.

FEO 2012 champion drop to No.5 in 2013 ... so 2014 must work triple hard

�

I glanced theough this report and it doesnt say anything about which company is really tops in real profits.

No. Of units sold is like the worst way to compare.

Say one developer sells 300 units of mickey mouse apartments vs one which sells 150 units of luxurious 1500 to 2000sft units. Does no. Of units tell the real story? Its no secret that developers HAD to cut unit sizes to bring down quantum as a way to boost sales.

Now they will absorb this and that etc...but still keep psf prices stagnant becos they are scared that once they cut psf$ upfront, it could lead to a complete market pullback.

You know lah, The market here is sibei herd type.

So many go by hearsay and the next agents' advice.

Look out fellas!

that's why i commented ... developer die die will not lower $psf ...

give hangbao $3888 $5888 $6888 simply peanut and loose change ...

�

Now they will absorb this and that etc...but still keep psf prices stagnant becos they are scared that once they cut psf$ upfront, it could lead to a complete market pullback.

You know lah, The market here is sibei herd type.

�

Edited by Wt_know, 26 January 2014 - 01:38 PM.

that's why i commented ... developer die die will not lower $psf ...

give hangbao $3888 $5888 $6888 simply peanut and loose change ...

�

�

Yes, die die will not, but sometimes dying is easier than not.

See who caves in first.

big brother selling emerging market currencies ... lai liao

don't play play

�

now sgd$1 = myr$2.6 ... myr$3 by 2015?

hopefully, sgd$ will not be beaten up badly ....

�

Investors around the world braced for another rough and tumble trading session Monday amid growing volatility in emerging markets.

Asian markets opened sharply lower as benchmark indices in Tokyo and Hong Kong shed more than 2% as investors looked to move out of riskier assets. South Korea's KOSPI Index and the Mumbai Sensex were off by 1.5%.

In currency markets, the yen gained ground against the dollar as investors parked their money in traditional safe havens. Emerging market currencies extended losses, building on a trend from last week that hit the Argentinian peso, Turkey's lira and India's rupee especially hard.

Emerging markets have been hammered in recent days due to the possibility that the Federal Reserve, Bank of England and Bank of Japan will pull back on propping up their own economies. Signs of weakness in China's huge manufacturing sector and a looming default in the shadow banking system have only added to worries.

"The fear is that the Fed, Bank of England, and even the Band of Japan will become less dovish more quickly than had been though even a few weeks ago," said Steven Englander, head of foreign exchange strategy at CitiFX.

Edited by Wt_know, 27 January 2014 - 02:34 PM.

Heheh.

Equivalent to price drop right?

�

dont say price drop! such a taboo�

�

it is just an incentive. price still stable! don't think too much.�

I bo eng, can you post the news on speculators exiting the property market in todays ST?

Heheh.

�

So when are you whacking the market with your full cash payment har?

�

If it sound too good to be true, it's probably is.

�

�

yeah... haha singapore's hottest investment.. HSBC recommended..

I bo eng, can you post the news on speculators exiting the property market in todays ST?

Heheh.

�

you mean the one which says that subsale last quarter is 147 units - lowest in 8 years?

�

yeah, all the speculators have now been converted into long term investors. convinced by cheng hu one

bought into some US ETFs jus tis month, US seems like recovering but this EM tumultuous just prove to me that no way i can time the market. am still thinking US ETF will be bullish tis year, intend to hold it for 5 yrs at least.

I bo eng, can you post the news on speculators exiting the property market in todays ST?

Heheh.

Or your watch sent for servicing is it?

Or your watch sent for servicing is it?

�

hmm..then he go chinatown buy casio and ask

�

'chey, who are these poor ppl buying swatch next to me'....mauahahahahah

Or your watch sent for servicing is it?

Aiyoh i hv more than one watch lah.

But sibei bo eng... Have to pay so many bills.

My HDB maintenance and parking also must pay.

Very tough life leh sole bread winner

check this out. Some 'experts' offering their views.

Sounds amageddon like that.

This time they also talk about how bad SG will get affected.

�

So when are you whacking the market with your full cash payment har?

Why do you still insist on putting words in my mouth?

I do not intend to full cash settle my next property investment.

Why do you still insist on putting words in my mouth?

I do not intend to full cash settle my next property investment.

�

ya when price crash, its time to max out mortgage, but frm my experience, its hard 2 get a bank 2 match asking price when its d bottom coz banks will b even more conservative than u when sh!t hits da fan!

�

http://forums.hardwa...xt-4549304.html

check this out. Some 'experts' offering their views.

Sounds amageddon like that.

This time they also talk about how bad SG will get affected.

�

There were also dozens of such articles during 2008 crisis, saying until like dooms day coming. In the end, see how fast the market rebounded from 2010 till now. I will take such article as reading pleasure nia.

�

There were also dozens of such articles during 2008 crisis, saying until like dooms day coming. In the end, see how fast the market rebounded from 2010 till now. I will take such article as reading pleasure nia.

�

so what's your position?

�

ya when price crash, its time to max out mortgage, but frm my experience, its hard 2 get a bank 2 match asking price when its d bottom coz banks will b even more conservative than u when sh!t hits da fan!

�

�

probably can get 40% to 50% LTV for resale

Last two weeks say 5% drop, now talking about 10% drop. I say at least 15 to 20% drop easily the next two years

Edited by Throttle2, 28 January 2014 - 02:56 PM.

Can someone post the news on ST today. Sibei bo eng......

Last two weeks say 5% drop, now talking about 10% drop. I say at least 15 to 20% drop easily the next two years

�

�

your watch servicing say so lah......we understand

this means property price is still fking high !!!

there is no other explanation, period.

Edited by Wt_know, 28 January 2014 - 08:00 PM.

Turkey delivers massive rate hike to defend Lira

http://www.cnbc.com/id/101359309

�

India Unexpectedly Raises Rate as Rupee Risks Inflation

http://www.bloomberg...get-mulled.html

�

US Federal Reserve poised for another taper of big stimulus

http://www.straitsti...imulus-20140129

�

if US taper another $10B down from $75B to $65B per month ...

USD goes up against other currencies ... who's next to raise interest rates if their currency devalue against USD?

Edited by Wt_know, 29 January 2014 - 07:48 AM.

Turkey delivers massive rate hike to defend Lira

http://www.cnbc.com/id/101359309

�

India Unexpectedly Raises Rate as Rupee Risks Inflation

http://www.bloomberg...get-mulled.html

�

US Federal Reserve poised for another taper of big stimulus

http://www.straitsti...imulus-20140129

�

if US taper another $10B down from $75B to $65B per month ...

USD goes up against other currencies ... who's next to raise interest rates if their currency devalue against USD?

Not so long ago, money market funds returned about 3-4% pa

Hope we can go back to that level this year

if interest rate return to 3-4%, upgrader just paying through their nose ... won't die one la

speculators and overstrechers maybe yes

but as govt pointed out, 70-80% of buyers are upgraders who buy to live in ... so bo taichi one

unless many upgraders lost their job due to economy crisis ... that's a different story

�

It is a no brainer that mass market private property will be hit the hardest. The craze of buying condos by upgraders are insane.

�

Edited by Wt_know, 29 January 2014 - 11:36 AM.

Edited by Mockngbrd, 29 January 2014 - 11:39 AM.

No wonder all our educated women going for ang mohs. Who can talk about anything under the sun and sound impressive too.

We Singaporean men have only ourselves to blame.

�

what do ang mo men talk about ah? usually i tok about work with them since colleagues. and also some bo liao things like travel etc. maybe my ang mo colleagues different from the ones working in cbd area.

�

�

�

wife's good friend..�

�

bought HDB at 300K. Sold at 500K

�

upgrade to condo at 1.1m. Sold at 1.6m

�

upgrade to good district condo at 2.5m... sold at ??? (in future)

�

of course, all these happened during the 2004 to 2013 period.

�

According to my mother in law and my wife, they are very clever. Even though debts went up from 100K to now 1m (or more?), they have "made it" in life.. no matter how the mkt crash, they will still be in the money. both couple working, raking in nearly 20K a month (main income earner in high risk industry aka financial services)

�

too difficult to explain to them, so i just go along and agree�

if we do not take value of money and loan interest payment into account, your wife's friend is still out of pocket by $900k. only way to negate that is to sell that $2.5m property and downgrade to cheaper housing to have net in. Assuming they sell their $2.5m property at breakeven and buy a $1m condo to stay in, their overall net in will be $600k. In a way, maybe your wife is right to say they have made it, but conditional on their willingness to stay in a cheaper house and use the $600k to reinvest.

if we do not take value of money and loan interest payment into account, your wife's friend is still out of pocket by $900k. only way to negate that is to sell that $2.5m property and downgrade to cheaper housing to have net in. Assuming they sell their $2.5m property at breakeven and buy a $1m condo to stay in, their overall net in will be $600k. In a way, maybe your wife is right to say they have made it, but conditional on their willingness to stay in a cheaper house and use the $600k to reinvest.

�

haha yea d value of d property doesnt reflect how much debt is taken. tats y SG has v few entrepeneurs, all playing d leveraged property game which requires income statements, hence d current property bubble.

�

N that guys MIL n wife r wrong. If say later this yr another global crisis n property crash -10 to -20%, their prop bot at $2.5M will b say valued at $2.15m, but their mortgage remains same value. Then their bank may ask them to topup d negative equity when the maintenance margin % is hit.

�

Assume they downpay $1M n took 1.5M loan, they may have to topup 2.5M - 2.15M = $350,000. So yes theyll still b in d money, but they need 2 know such situations have occured in d past, eg. 2008 & asian financial crisis.

�

Super worse case is if their property drops 40% in value, then all gains since their first HDB will b gone if bank ask for topup. N this assumes they paid for their first HDB in cash... if they took 80% loan, totally out of money liao.

Edited by Duckduck, 29 January 2014 - 01:23 PM.

0-20% drop = bo tai chi right since LTV is 80% previously

�

even drop >20% ... let's say slightly 25% ... bank rarely make margin call if the loan has been serviced timely and no credit bad history. i was told even during sars (2003) and lehman collapsed (2009), there was hardly anyone kena margin call. the 1997 financial crisis, yes, many were forced to sell their property because that time really sibei jialat and financial institution know sh.it how to deal with the problems.

�

as what we were told, bank balance sheet is super duper sibei tok kong ... won't easily foreclosure leh ... no?

�

i think sars time, hdb also give chance and let owner to defer payment for up to 6-months ...

Edited by Wt_know, 29 January 2014 - 01:30 PM.

0-20% drop = bo tai chi right since LTV is 80% previously

�

even drop >20% ... let's say slightly 25% ... bank rarely make margin call if the loan has been serviced timely and no credit bad history. i was told even during sars (2003) and lehman collapsed (2009), there was hardly anyone kena margin call. the 1997 financial crisis, yes, many were forced to sell their property because that time really sibei jialat and financial institution know sh.it how to deal with the problems.

�

as what we were told, bank balance sheet is super duper sibei tok kong ... won't easily foreclosure leh ... no?

�

i think sars time, hdb also give chance and let owner to defer payment for up to 6-months ...

�

there were def margin calls but not many until media picked up. banks watch individuals n corporates which r v aggressive n buying n maxing out loans. these guys they will easy easy give them mortgage, but when crash these same guys will kena makan.

�

D avg conservative household dont do such things so banks arent gona margin call so fast, but those aggressive types, banks have no mercy. My bank frens told me if QE didnt happen, confirm much more margin calls were gona happen.

�

Wat happens next crisis? We wish recovery wld b short n sharp like 2009, but nobody can tell d future right...

�

Eg. many kept saying interest rates will remain damn low for long time, but guess wat d US Fed started tapering already, forward rates r rising already. Once US economy is fixed in few yrs time, they wont care if SG property crashes due to SIBOR hitting 3-4%, they only care for themselves.

�

Edited by Duckduck, 29 January 2014 - 01:40 PM.

fully agreed on what you said. bank has no mercy, period.

bank is not charity and 1st priority to recover not just their capital but also their profits.

another thing is US Fed policy is always push out to save themself and political motivated. who cares what's happening outside.

but they themself keep haunting china to increase and keep china high gdp to sustain the world economy.

�

�

there were def margin calls but not many until media picked up. banks watch individuals n corporates which r v aggressive n buying n maxing out loans. these guys they will easy easy give them mortgage, but when crash these same guys will kena makan.

�

D avg conservative household dont do such things so banks arent gona margin call so fast, but those aggressive types, banks have no mercy. My bank frens told me if QE didnt happen, confirm much more margin calls were gona happen.

�

Wat happens next crisis? We wish recovery wld b short n sharp like 2009, but nobody can tell d future right...

�

Eg. many kept saying interest rates will remain damn low for long time, but guess wat d US Fed started tapering already, forward rates r rising already. Once US economy is fixed in few yrs time, they wont care if SG property crashes due to SIBOR hitting 3-4%, they only care for themselves.

�

�

Edited by Wt_know, 29 January 2014 - 01:51 PM.

�

haha yea d value of d property doesnt reflect how much debt is taken. tats y SG has v few entrepeneurs, all playing d leveraged property game which requires income statements, hence d current property bubble.

�

N that guys MIL n wife r wrong. If say later this yr another global crisis n property crash -10 to -20%, their prop bot at $2.5M will b say valued at $2.15m, but their mortgage remains same value. Then their bank may ask them to topup d negative equity when the maintenance margin % is hit.

�

Assume they downpay $1M n took 1.5M loan, they may have to topup 2.5M - 2.15M = $350,000. So yes theyll still b in d money, but they need 2 know such situations have occured in d past, eg. 2008 & asian financial crisis.

�

Super worse case is if their property drops 40% in value, then all gains since their first HDB will b gone if bank ask for topup. N this assumes they paid for their first HDB in cash... if they took 80% loan, totally out of money liao.

�

stay 2.5M property surely have 1M spare cash lying around right? no?

�

tablewiper stays CCK 4 room HDB also have a few millions waiting for crash

�

stay 2.5M property surely have 1M spare cash lying around right? no?

�

tablewiper stays CCK 4 room HDB also have a few millions waiting for crash

3 room flat hor......

A few million rupiah....

:)

first turkey, then india ... now comes south africa

�

South Africa's central bank hikes key rate to 5.5%

Edited by Wt_know, 29 January 2014 - 10:30 PM.

first turkey, then india ... now comes south africa

�

South Africa's central bank hikes key rate to 5.5%

Ooooooohhhh.

siao liao ... less $10B to burn pumping the stock market

�

Fed continues taper as Bernanke's term ends

Edited by Wt_know, 30 January 2014 - 07:31 AM.

your maths not good. how you arrive at out of pocket $900k? nobody catch this maths error meh?if we do not take value of money and loan interest payment into account, your wife's friend is still out of pocket by $900k. only way to negate that is to sell that $2.5m property and downgrade to cheaper housing to have net in. Assuming they sell their $2.5m property at breakeven and buy a $1m condo to stay in, their overall net in will be $600k. In a way, maybe your wife is right to say they have made it, but conditional on their willingness to stay in a cheaper house and use the $600k to reinvest.

they only made $700k paper profit so for the 2.5mil property 1.8mil is out of own pocket...

Edited by Wind30, 30 January 2014 - 07:43 AM.

Yeahhh taper taper taperingggg.

�

Sidenote anecdote: My property agent/family friend called me yesterday to wish happy CNY and catch up. I asked how the market is for him, the usual reply came back. Private resale still holding for now or slight drop. HDB in mature estates or central areas also holding, but outlying estates seeing big drops. One place in punggol apparently sold 70k below valuation. Huat ah!

how long can the market hold up? another 1-2 years?

cheap money still available although is not as much as previously

from $85B to $65B per month and interest rate is kept at near 0 for the next 2 years (at least)

Edited by Wt_know, 30 January 2014 - 08:27 AM.

how long can the market hold up? another 1-2 years?

cheap money still available although is not as much as previously

from $85B to $65B per month and interest rate is kept at near 0 for the next 2 years (at least)

�

cut cut cut...

�

�

nikkei drop 3% liao...

Just another note -�

�

NZ reserve bank is supposed to be raising rates these next few weeks....

�

Interest rates expected to go up by at least 3% over the next few years.�

�

Wooohooo.

Edited by Throttle2, 30 January 2014 - 09:19 AM.

if we do not take value of money and loan interest payment into account, your wife's friend is still out of pocket by $900k. only way to negate that is to sell that $2.5m property and downgrade to cheaper housing to have net in. Assuming they sell their $2.5m property at breakeven and buy a $1m condo to stay in, their overall net in will be $600k. In a way, maybe your wife is right to say they have made it, but conditional on their willingness to stay in a cheaper house and use the $600k to reinvest.

�

think the accounting for the profit is not so simple as to price 1 - price 2 = profit..

�

there is stamp duty involves and 2.5m stamp is ard 75k.. which is pretty signicifcate.. not forgetting agent fee� etc . you also assume that that they sell each house after paying for the house.. which may not be true. I wont be surprise that they already have 1 mil in the bank on investment, while the 2.5 mil is on low-int mortgage..

�

in any case, there are finer details that will determine if you could surive a crisis.

1) your mthly mortage amt ..

2) income source . 1-2 or more

3) cash buffer

4) % of loan

5) location of the property - ease of rent

�

most imptly, if that is your only house. if it is, then will be harder to sell. Too much emotion and logistic involve.

if stock crash this CNY month, 6 months later property mkt going to crash?

Yeahhh taper taper taperingggg.

�

Sidenote anecdote: My property agent/family friend called me yesterday to wish happy CNY and catch up. I asked how the market is for him, the usual reply came back. Private resale still holding for now or slight drop. HDB in mature estates or central areas also holding, but outlying estates seeing big drops. One place in punggol apparently sold 70k below valuation. Huat ah!

Property agents are all brainwashed to think the market is superman.

Forget about asking them for opinions on the property market lah, you know what the reply will be.

Muayhahahah.

if stock crash this CNY month, 6 months later property mkt going to crash?

I dont think its fair to correlate the two this way.

Property agents are all brainwashed to think the market is superman.

Forget about asking them for opinions on the property market lah, you know what the reply will be.

Muayhahahah.

I dont think its fair to correlate the two this way.

�

property price lag 6 to 12 months behind stock market bah

�

�

property agent and car dealer is the last person you want to ask for opinion

ironically, they are suppose the "professional" who has the know-how and first hand information to advise you. but they are blinded by greed and incentives to close deal. hence, good or bad time ... everyday is good to buy and sell.

�

that's why i'm dumbfounded that how property agent and car dealer actually benefit buyer and seller.

�

anyway, whether property market crash after cny or not ... huat ah!

every crash is opportunity and they are people who made a lot of money from each crash.

crash made money, economy skyrocketed like in 2012-2013 also made money no $1M no talk.

Edited by Wt_know, 30 January 2014 - 09:45 AM.

Property agents are all brainwashed to think the market is superman.

Forget about asking them for opinions on the property market lah, you know what the reply will be.

Muayhahahah.

I dont think its fair to correlate the two this way.

�

No lah, this fellow is family friend for over 20 years and knows we're not in the market to buy or sell.�We were�talking about my dad's recent illness and his recovery, then I itchy backside ask him how the market is now.

�

But agreed maybe it's a hopeful opinion since most people are not keen to face up to potential bumps in the road. I wish him well anyways, he's the plodding sort not the flashy type so whether market up or down he just quietly goes about his work.

�

property price lag 6 to 12 months behind stock market bah

�

�

�

correlation is questionable but as i mentioned before this time HDB resale doesnt have downside cushion of undersupply. HDB is d biggest mkt in SG, so when d biggest mkt is under pressure, likely everything else gets hit. Why? Coz if pple staying in HDB cannot get more cash, they cannot push up mass mkt, in turn mass mkt cannot sell at premium n cannot upgrade to prime, so its chain reaction.

�

As for COE impact if SG enters bear mkt, there is limited downside due to quota constraint but will still fall to a certain lvl.

�

For me, im back to looking at my old spreadsheet which i last used in 2009. Flipped out liao now waiting 2 makan some good deal. D9-D10 alot of resale under pressure liao

Edited by Duckduck, 30 January 2014 - 10:20 AM.

how long can the market hold up? another 1-2 years?

cheap money still available although is not as much as previously

from $85B to $65B per month and interest rate is kept at near 0 for the next 2 years (at least)

�

If the market can hold up for another 1 to 2 years, a lot more ppl will continue to invest into property. Many hands are itchy, can only hold out for months, not years.

�

If the market can hold up for another 1 to 2 years, a lot more ppl will continue to invest into property. Many hands are itchy, can only hold out for months, not years.

�

there will b buyers on way up, as well as on way down.

�

�

No lah, this fellow is family friend for over 20 years and knows we're not in the market to buy or sell.�We were�talking about my dad's recent illness and his recovery, then I itchy backside ask him how the market is now.

�

But agreed maybe it's a hopeful opinion since most people are not keen to face up to potential bumps in the road. I wish him well anyways, he's the plodding sort not the flashy type so whether market up or down he just quietly goes about his work.

�

Not all agents are BS lah. Part timers like me will just call as i see it. selling a few more units a year isn't going to make me any richer anyway.

�

Having said that, i do see some agents really believe in the prata story they sell. They put money where their mouth is and are buying properties (mainly overseas) at this time.

D9-D10 always provide the best rate of return

�

but recently all the so called property analysts try to cook up the story of jurong and woodland regional centre and also punggol the next big thing.

�

�

correlation is questionable but as i mentioned before this time HDB resale doesnt have downside cushion of undersupply. HDB is d biggest mkt in SG, so when d biggest mkt is under pressure, likely everything else gets hit. Why? Coz if pple staying in HDB cannot get more cash, they cannot push up mass mkt, in turn mass mkt cannot sell at premium n cannot upgrade to prime, so its chain reaction.

�

As for COE impact if SG enters bear mkt, there is limited downside due to quota constraint but will still fall to a certain lvl.

�

For me, im back to looking at my old spreadsheet which i last used in 2009. Flipped out liao now waiting 2 makan some good deal. D9-D10 alot of resale under pressure liao

�

Edited by Wt_know, 30 January 2014 - 10:23 AM.

�

there will b buyers on way up, as well as on way down.

�

�

true. Boom time or market crash all will have transactions. for an agent, his only job is to make sure the transaction is closed by him and not someone else.�

�

correlation is questionable but as i mentioned before this time HDB resale doesnt have downside cushion of undersupply. HDB is d biggest mkt in SG, so when d biggest mkt is under pressure, likely everything else gets hit. Why? Coz if pple staying in HDB cannot get more cash, they cannot push up mass mkt, in turn mass mkt cannot sell at premium n cannot upgrade to prime, so its chain reaction.

�

As for COE impact if SG enters bear mkt, there is limited downside due to quota constraint but will still fall to a certain lvl.

�

For me, im back to looking at my old spreadsheet which i last used in 2009. Flipped out liao now waiting 2 makan some good deal. D9-D10 alot of resale under pressure liao

�

I am using window period from 97/98 AFC, 08/09 US meltdown

�

I am using window period from 97/98 AFC, 08/09 US meltdown

�

97/98 was worse than 08/09, coz 08/09 hDB was undersupplied, but 97/98 had HDB oversupply, LIKE NOW ONWARDS.... fingers crossed deja vu dont happen, but ever since QE happened n when i saw Asia rebound, immediately i thot 98 crisis n all d bankruptcies which followed... lets hope not.

Edited by Duckduck, 30 January 2014 - 10:29 AM.

i don't think there would be a "fatal crash" per se even there is a price correction especially the govt had put in the emergency brake (8 CMs) and already slowly braking the charging train (supply & demand). even it crashed, it gonna be knocks and dents but not fatal.

Edited by Wt_know, 30 January 2014 - 10:35 AM.

�

97/98 was worse than 08/09, coz 08/09 hDB was undersupplied, but 97/98 had HDB oversupply, LIKE NOW ONWARDS.... fingers crossed deja vu dont happen, but ever since QE happened n when i saw Asia rebound, immediately i thot 98 crisis n all d bankruptcies which followed... lets hope not.

�

�

really hope that public housing prices will go down for good..

�

the only problem is good chunk of the sales involve seller that are receiving their new bto / EC. Not really sell because of financial hardship.

�

Let's see how the next few mths pan out. Any change in immigration policy and stamp fee may have significate impact to mass mkt condo and public housing..

�

i don't think there would be a "fatal crash" per se even there is a price correction especially the govt had put in the emergency brake (8 CMs) and already slowly braking the charging train (supply & demand). even it crashed, it gonna be knocks and dents but not fatal.

�

�

really depend how good in them removing the ebrake..

�

if they release too slow.. the mkt may have freefall because herd mentality..

�

if they release too fast.. it will negate all their prev effort.

�

�

the only consolation is that if it freefall, most ppl have enuff reserve to draw on.

Edited by ShepherdPie, 30 January 2014 - 10:42 AM.

�

97/98 was worse than 08/09, coz 08/09 hDB was undersupplied, but 97/98 had HDB oversupply, LIKE NOW ONWARDS.... fingers crossed deja vu dont happen, but ever since QE happened n when i saw Asia rebound, immediately i thot 98 crisis n all d bankruptcies which followed... lets hope not.

�

08/09 I am talking about how US real estate prices crashed...

�

Let's see how the next few mths pan out. Any change in immigration policy and stamp fee may have significate impact to mass mkt condo and public housing..

�

For them to remove say ABSD or SSD, I thk URA PPI has to show a 10-15% decline first, then they have reason to say that prices have stabilized n theres no more bubble.

�

property prices had run up 50% (ie: $800K+ 3-bedder pigeon hole condo already selling at $1.2M+) ...

$1M-$1.2M+ is the mass market price now ... which all the analist said "affordable" price range

decline 10-15% means still got 30-35% profit ... huat ah!

�

�

For them to remove say ABSD or SSD, I thk URA PPI has to show a 10-15% decline first, then they have reason to say that prices have stabilized n theres no more bubble.

�

�

Edited by Wt_know, 30 January 2014 - 12:58 PM.

property prices had run up 50% (ie: $800K+ 3-bedder pigeon hole condo already selling at $1.2M+) ...

$1M-$1.2M+ is the mass market price now ... which all the analist said "affordable" price range

decline 10-15% means still got 30-35% profit ... huat ah!

�

�

�

thats how it is, in general property goes up, so if prices do fall 10-15%, n some already have, its good time to enter for those waiting. i already KIV a few liao. THose gona TOP this yr n next yr dam good targets coz those early flippers also wanna get out

�

08/09 I am talking about how US real estate prices crashed...

�

property has 2 major attributes which its affected: 1) economic condition 2) supply/demand situation

�

both shld b analyzed separately n then added together to come to a conclusion.

�

Eg. 2 yrs ago i was posting abt possible supply/demand problem in SG prop but alot kept slamming me n saying im crazy etc. Back then QE was still ongoing so economy was not bad. Now taper liao plus supply/demand everyone reverse gear n become cautious.

�

Really nobody can tell future n i dont believe in efficient mkts, as in prop prices may not drop alot even if got over supply. such is life

because govt will chut pattern ... still got absd, ssd, tdsr, ltv, abcdefg ... lol

Edited by Wt_know, 30 January 2014 - 03:18 PM.

property prices had run up 50% (ie: $800K+ 3-bedder pigeon hole condo already selling at $1.2M+) ...

$1M-$1.2M+ is the mass market price now ... which all the analist said "affordable" price range

decline 10-15% means still got 30-35% profit ... huat ah!

�

�

Eh, corrections.

That is mathematically wrong.

Eg.

Say $50 become $100, thats 100% increase.

From that $100, it just has to drop 50% to take it back to $50

Likewise if a property valuation has gone up from $1mil to $1.5mil (50% increase) it only takes about 30% decrease to take it back to where it started.

If historical price behaviour is anything to go by, sell offs / crashes are always more pronounced.

The reason why the CMs didnt have speedy impact on the upside will be the reason why the removal of CMs wont have speedy impact on the downside. Unless they counter with removl of several CMs at one go, then maybe, just maybe

I'm hearing 2 school of thought from casual chat with colleagues, although I'm not in properties, well, just lunch kaki chat lor...to be honest ... i still dont think property will crash ... 10-15% correction, yes

because govt will chut pattern ... still got absd, ssd, tdsr, ltv, abcdefg ... lol

One side would never believe the market will crash, or fall badly.. This group always believe the gov will not allow that to happen.. Political suicide to allow that to happen since 2016 is just around the corner..

On the other group, they don't believe gov can do much since sg is hugely affected by external factor and if market crash, it's to their advantage since political change is the last thing people want when times are bad..

Hehehe... Anyway, I prefer market to drop to a sane level so that my kids don't have to sell backside just to buy a hdb in 15-20yrs time.. Hehehe...

Không có nhận xét nào:

Đăng nhận xét